Smart Budgeting Tips for Monthly Earners in Saudi Arabia

Living in Saudi Arabia brings unique opportunities—and challenges—when it comes to personal finance. From navigating local banking systems to managing everyday expenses like groceries and rent, budgeting your monthly salary wisely can mean the difference between financial stress and long-term stability. Whether you’re an expat or a local resident, this guide offers practical tips to help you stretch your paycheck and build financial confidence.

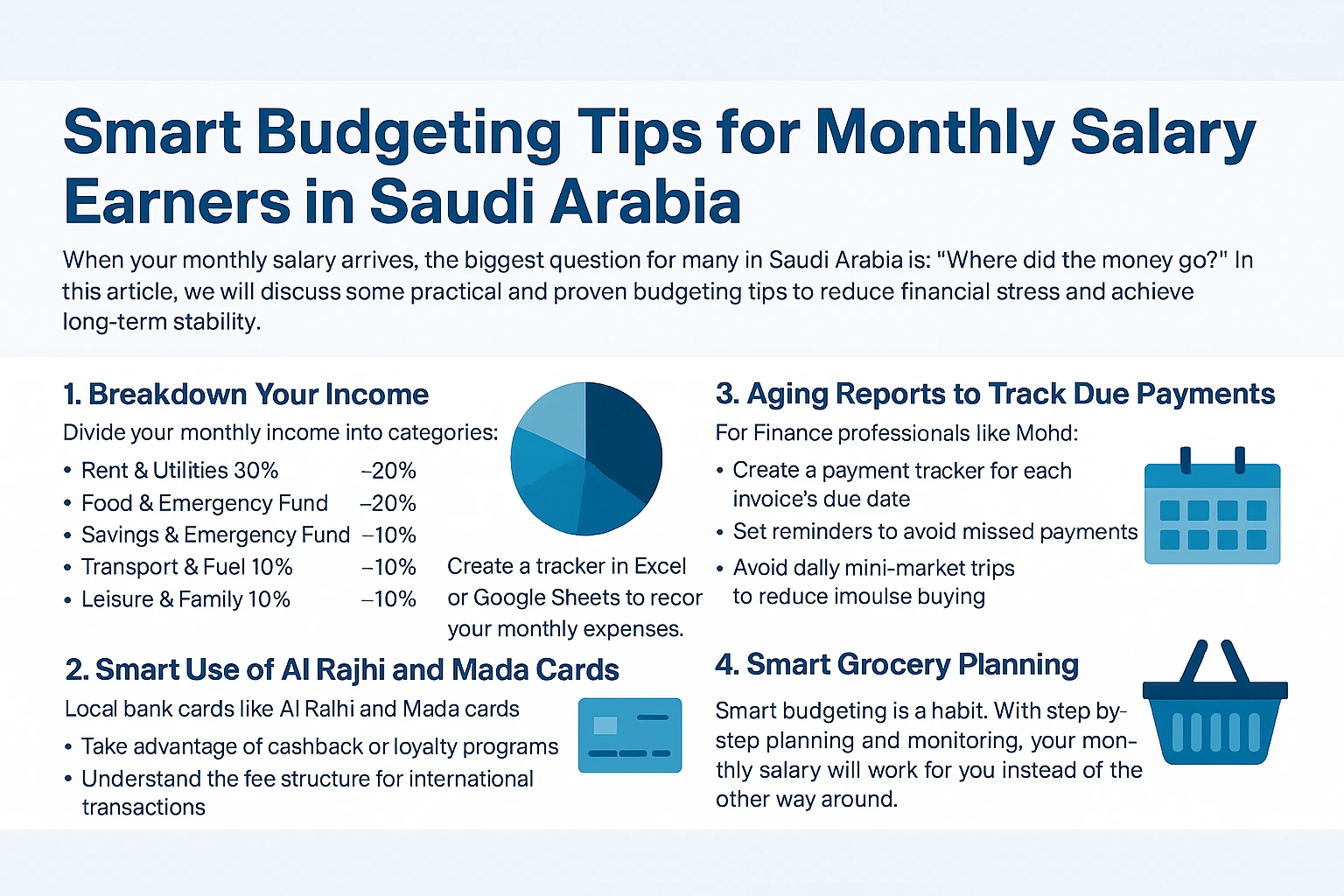

🧮 1. Break Down Your Monthly Income

Start by creating a financial blueprint of how your money will be allocated:

– 🏠 Housing & Utilities: Around 30% of your income typically goes to rent, electricity, and internet.

– 🍽️ Food & Essentials: Allocate 20% for groceries, toiletries, and household items.

– 💳 Savings & Emergency Fund: Put aside at least 20% for future needs.

– 🚘 Transport & Fuel: Around 10% for car expenses or public transport.

– 🎉 Leisure & Family: Another 10% for entertainment, outings, or family support.

– 📱 Subscriptions & Miscellaneous: The last 10% can cover mobile plans, apps, and other personal expenses.

Use tools like Google Sheets or a budgeting app to visualize your breakdown and track expenses month-to-month.

💳 2. Maximize Benefits from Al Rajhi & Mada Cards

Local bank cards offer more than just payment access—if used wisely:

– ✅ Cashback Deals: Al Rajhi credit cards often come with reward points or cashback offers.

– 🌐 Know Your Fees: Be aware of transaction charges, especially for international use or online payments.

– 🔒 Security First: Turn off auto-renew options for subscriptions to prevent surprise deductions.

Understanding these systems not only helps you avoid hidden fees but also turns your card usage into a budgeting asset.

📆 3. Track Due Payments with Aging Reports

Whether you’re freelancing or managing household bills, this tip is key:

– 📊 Use an aging report template to monitor when payments are due.

– 🔔 Set reminders via calendar apps or SMS alerts to ensure on-time payments.

– 💼 This tactic is used in professional settings—and it works wonders for personal finances too.

You’ll never lose track of important bills again, and your credit history will thank you.

🛒 4. Grocery Planning: Save Without Compromise

In a market full of options, planning is everything:

– 🛍️ Buy in bulk from hypermarkets or wholesale vendors—especially for dry goods and cleaning supplies.

– ❄️ Set your fridge properly to avoid food spoilage. Knowing your appliance settings saves money long-term.

– 🚫 Avoid daily visits to mini-markets; impulse buying eats away your budget.

Meal planning apps can be a great companion here, allowing you to stay within limits while keeping meals interesting.

🎯 Final Tips for Financial Discipline

– 🧠 Practice mindful spending: Pause before each purchase—is it really needed?

– ✍️ Keep receipts or photos of transactions—it helps when reconciling your monthly records.

– 🏦 Review your banking app weekly for insights and usage trends.

🌟 Conclusion

Smart budgeting isn’t about being frugal—it’s about being intentional. With some planning and discipline, your monthly salary can provide more than just survival; it can offer growth, leisure, and savings. Whether you’re using Al Rajhi cards strategically or streamlining grocery runs, every small step adds up.

Your money should work for you—not the other way around. Google